/chart_graph_technical_analysis_shutterstock_454129360-cfc50944d8c54bb0a8f32a9a91f17b76.jpg)

It has happened to me many times that the market is right at my limit order and the limit order is not triggered. Either your limit order is not executed or the direct market execution is delayed by a few points.

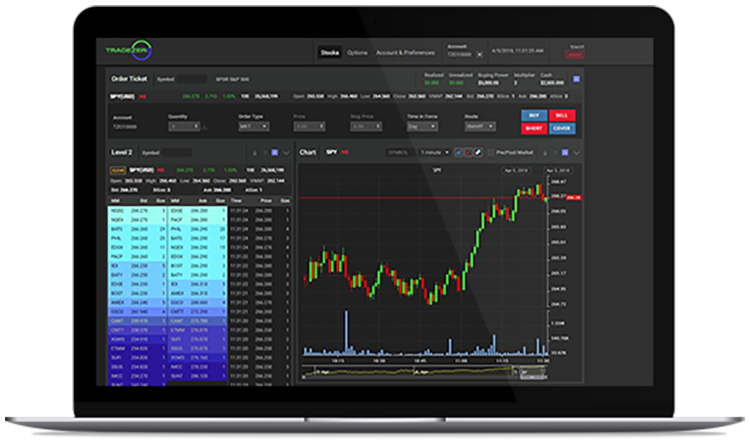

As a trader, you may not get an execution at the price you want. Institutions or banks with a lot of money have the best infrastructure for trading. Generally, private traders always get the worst execution in the markets. Professionals also call this system a “matching engine”. The exchange constantly changes the price between the next “BID” or “ASK”. Depending on supply or demand, the price rises or falls. If there are too few limit orders on a price, the exchange must find a new price. The market order triggers the limit order. Other traders then buy or sell directly at the current price. Traders use these limit orders to say that they want to buy or sell at a certain price. On the “BID” and “ASK” the limit orders are waiting to be triggered. It shows you strong buying or selling pressure. It depends on your strategy which imbalances you want to show. These are imbalances that are market automatically. Red or green colored numbersĪlso, in the picture, you see red and green colored numbers.

ASK means limited sell orders which are triggered by market buy orders. BID means limited buy orders which are triggered by market sell orders. For interpretation, you can see where is the most volume traded and where it is not. The market orders are working up and down towards the order limits. More about this technique you can read in the article “ order flow trading“.įor example, if somebody buys a market you will see the trade in the footprint chart if the trader got filled. The market works through the limited order book and is moving by market orders or stop orders which get triggered. This gives you the possibility of different trading strategies. Now you can analyze if the volume is on the high, middle, or bottom of the candle. There are different settings but the most popular setting is the most traded volume. It is a market with the box in the candle but it depends on your order flow trading software. It is the price where the most volume is traded. The Footprint Chart candle shows you like the normal candle the candle closes and opens. The Footprint Chart candle shows you like the normal candle the high and low.

0 kommentar(er)

0 kommentar(er)